WASHINGTON — The Internal income Service these days defined how expanded tax Gains may also help each persons and corporations give to charity before the finish donation to charity from ira of this yr.

involve your Actual physical mailing address and EIN (Employer Identification quantity). Although not demanded, donors will need to offer this data with their taxes. for that reason, it’s A sort gesture to supply all of that information and facts for your supporters’ advantage.

should you’re a nonprofit located in The usa, it’s vital in order that your nonprofit donation receipt template incorporates all these things, as failing to do so could result in penalties or lack of tax-exempt status to your Firm.

The regulation now permits electing men and women to use an elevated limit ("enhanced particular person Limit"), as much as a hundred% in their AGI, for capable contributions created through calendar-12 months 2021. skilled contributions are contributions created in cash to qualifying charitable businesses.

Payroll Deductions: For charitable contributions produced by payroll deduction, the donor may use each of the next files as being a written interaction from the charity:

Donorbox donor administration helps make this simple and automated. just about every donation you receive by means of your Donorbox strategies receives saved within your donation databases, so you can conveniently pull details on how a campaign is carrying out.

typically, itemizers can deduct 20% to 60% in their modified gross income for charitable donations. the precise proportion depends upon the type of capable contribution in addition to the charity or Group. Contributions that exceed the limit may be deductible in upcoming years.

there are lots of main reasons why donors opt to give – at the end of the yr And through the rest of the 12 months: supporting a cause they care about, leaving a good legacy, or performing upon their own moral philosophy.

as part of your templates, you ought to go away room to incorporate all of the data expected via the IRS, along with a sincere thank you concept telling the donor the amount their contribution usually means on your Corporation.

normally, the amount of charitable cash contributions taxpayers can deduct on agenda A being an itemized deduction is limited to a percentage (normally 60 percent) of your taxpayer’s altered gross income (AGI). skilled contributions are certainly not subject to this limitation.

This means tracking your donations and making sure all of your current donors are sufficiently acknowledged is simpler than previously.

The IRS delineates that donation receipts must be offered “in writing, at some time of solicitation or in the event the payment is gained, As well as in a method that can arrive at the attention in the donor,” As outlined by IRS Publication 1771. Most nonprofit companies deliver out donation receipts to donors no later on than January 31 of your 12 months adhering to the day of your donation.

there won't be any regulations about once you need to problem Formal donation receipts. a lot of nonprofits deliver receipts out by the top on the year or in January of the following yr (in the event of year-stop donations).

By issuing donation receipts, you’re don't just acknowledging your donors’ generosity and also supplying them with the mandatory documentation to aid a tax deduction for his or her charitable contributions.

Danny Tamberelli Then & Now!

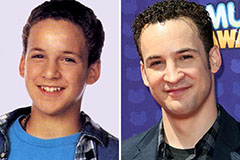

Danny Tamberelli Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Michael J. Fox Then & Now!

Michael J. Fox Then & Now! Brandy Then & Now!

Brandy Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now!